There are a few additional controls in BETA related to Spain’s Verifactu requirements that you should be aware of.

- Each transaction in BETA can contain up to 12 line items. This limit exists to remain compatible with the Verifactu system.

- BETA will upload all invoices to Verifactu as “facturas simplificadas”. These can generally be used up to a total value of €3,000 (including VAT) for eligible operations such as retail sales and sports facility services.

- If you need to issue a sale above this amount, it must be recorded separately in the Verifactu system. Please contact support if you expect to issue invoices over this threshold regularly so that the correct process can be confirmed.

- You can store a customer’s NIF in their BETA profile. When set, this NIF will be included on the invoice sent to Verifactu.

- The NIF and customer name must match the Spanish Tax Agency’s records. If they do not match, Verifactu will return an error. In that case, you can correct the customer’s name or NIF in BETA and then resubmit the invoice from the sales page.

- When you first set the NIF in the customer profile, BETA uses the Tax Agency’s validation services to check that the NIF and name are valid and consistent. If the name is changed later in BETA without updating the NIF, validation errors may still occur when sending documents to Verifactu.

- Receipts sent by BETA do not include the Verifactu QR code by default. In some cases there can be a delay before Verifactu finishes processing the invoice, so the QR code is not always available immediately.

- Once Verifactu has completed processing the document, BETA will provide an option for you to generate or send a version of the receipt that includes the QR code.

- BETA automatically attempts to upload the document to Verifactu whenever a transaction is finalized or refunded.

- If an error occurs, you will not receive a separate notification, but the transaction view will clearly show that there was a problem with the Verifactu upload and that the document needs updating.

- Invalid or unsupported VAT (IVA) rate or type.

- Invalid customer NIF, or a mismatch between the NIF and the customer’s name.

- After correcting the relevant data (for example, adjusting the VAT rate or fixing the customer NIF/name), you can resubmit the document to Verifactu from the sales or transaction page.

Please send is the information below

Your company NIF*

Details of the responsible signer including:

Full name*

NIF*

Municipio representante*

Calle representante*

Número representante*

We will provide you with a PDF you need to electronically sign

Return the electronically signed PDF to us

All complient now

The most well-known application for signing PDF documents is Adobe Acrobat , which can be downloaded for free and used to electronically sign PDFs.

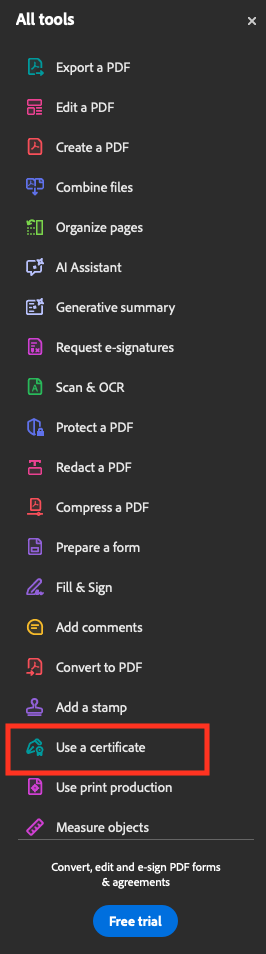

While there is a paid version, it's perfectly possible to sign documents with the free version. In the left-hand menu, select the " Use a certificate" option , as shown in the image .

You can also use the AutoFirma program , created by the Spanish Government to facilitate the electronic signing of documents.

Once your integration is live, you can input your QR code in the receipt emails. Using a tag {{QR}} this QR will be the input of the QR code.

Still Lost? We’ve got you covered!

Use the search box on the main Help to search the entire list of available help guides, or drop your question in the Support Chat!