Quickbooks (QB) is a premier cloud-based accounting platform for streamlined financial management. The Quickbooks integration is available for BETA users on Community tier or higher.

Below is an overview of the entire process, and what you need in place, to keep your BETA transactions flowing into the accounting software automatically.

In BETA’s Integrations settings, authorize access to your QB organization. Ensure API access is enabled in QB and that your BETA and QB time-zones match.

In BETA’s QB integration settings, choose how you’d like your transactions bundled each night into the Draft Journal.

You can group by:

This setting determines exactly which subtotals appear on each journal line, so that you see the right level of detail when you review and post in QB.

On first connect, BETA will generate three default accounts in QB:

BETALIAB (liabilities)

BETACURR (bank/cash movements)

BETASL<TAX> (one for each sales tax rate)

If you prefer your own accounts, you can rename or map Price Categories to any existing QB account code.

In BETA, list all your Price Categories (e.g. “Day Pass,” “Membership,” “Cafe:Drinks”).

For each Category, either:

Exact-match its name to a QB account, or

Enter a custom Account Code in BETA to override the default.

Categories using a colon (e.g. Cafe:Food) will post subtotal lines under the parent account (Cafe).

When using the QB integration, your Price Categories in BETA must match the account names in your accounting system for the integration to work properly.

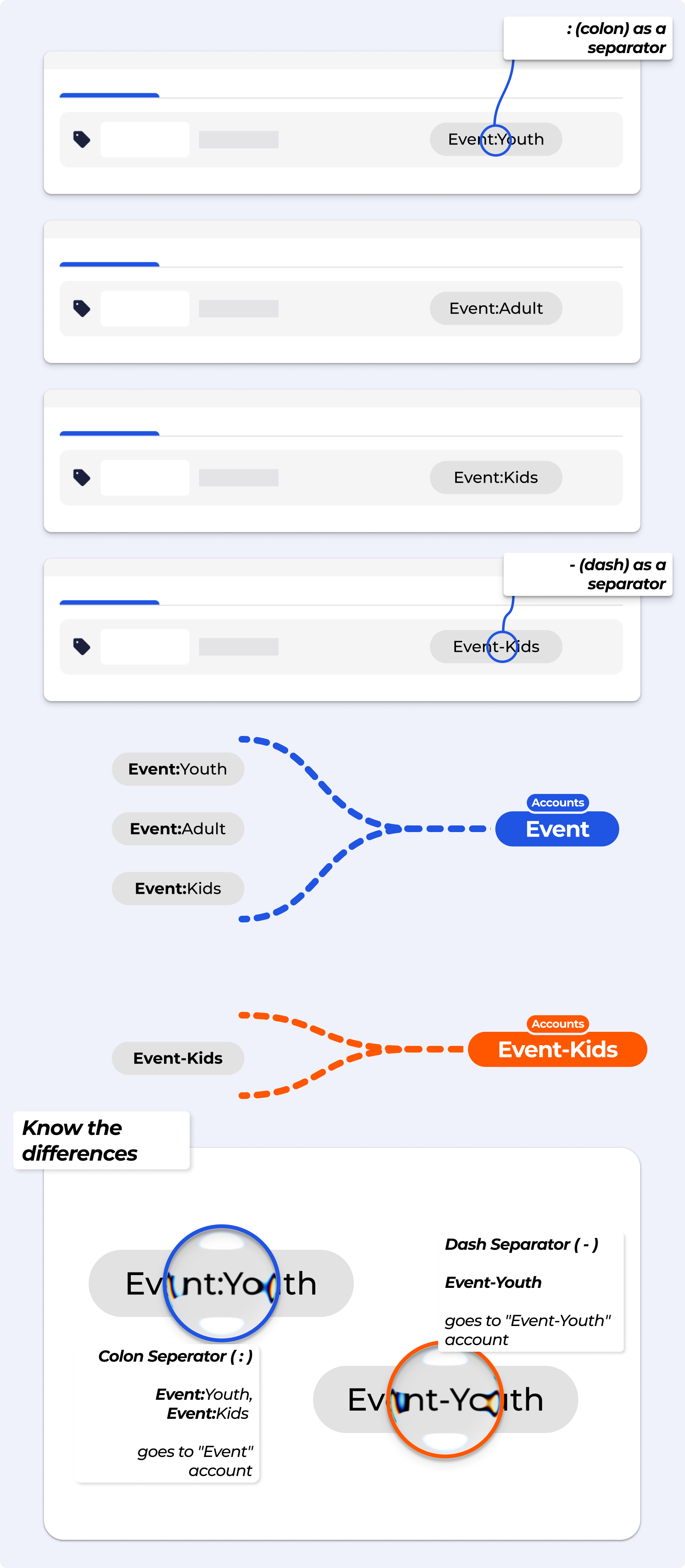

: & -

BETA looks at the text before the colon : when sending data to QB.

a) For example, these all map to the same account:

Event:Youth

Event:Kids

Event:Adult

All three go to the "Event" account in QB

b) If you use a dash - instead of a colon:

Event-Youth is treated as a completely different account called “Event-Youth.”

It will not be grouped with “Event.”

c) If no colon is used,

BETA simply looks for an exact match to your account name or falls back to BETASL<TAX>.

Use a colon

:to group categories to the same account

Avoid using a dash

-if you want items to go to the same account.

🔗Manage Products, Product Options & Product Prices

This is a new page

At 1 AM daily, BETA gathers all day’s sales, refunds, gift-cards, deposits, payroll, etc., into a single Draft Journal in Quickbooks. Lines are grouped by Price Category (or fallback BETASL<TAX>), tax rate, and payment type.

BETASL<TAX> sales account for that item’s tax rate.In BETA you can run a report, which will export a .csv of how your Price Categories match with the accounts you have set up in your Quickbooks.

If you’re using QuickBooks, click the “QuickBooks” option under the integration settings.

Note: If you operate with multiple locations, be sure to download and check the mapping at each location—especially if you use a separate QuickBooks account per location.

Open the Draft Journal in Quickbooks, confirm totals and account breakdowns, then click Approve.

Once approved, the journal is posted to your Chart of Accounts » no manual exports or .csv are required. These are updated and set to run, depending on the frequency you have chosen.

When you integrate your BETA climbing gym software with Quickbooks, the system will automatically create specific accounts in Quickbooks to help manage your financial transactions.

Here's what you need to know about these accounts:

BETALB : This account is created for all current liabilities, such as deposits and unredeemed gift cards.

BETACR : This account is designed to manage all incoming payments.

BETAS{TAXRATE} : For each tax rate at which you sell products, a unique account is generated with the name above followed by the applicable tax rate. These accounts help you categorise sales based on different tax rates.

LIABILITIES ACCOUNT

The liability account increases in value (a CREDIT) when:

The liability account increases in value (a CREDIT) when:

A gift card is purchased

Payments are taken for a transaction that is not finalized (a deposit)

A transaction is closed with subscription billing. </aside>

The liability account decreases in value (a DEBIT) when:

The liability account decreases in value (a DEBIT) when:

A gift card is redeemed

Payments attached to transactions that were never finalized are refunded

Transactions with deposits taken on previous days are finalized.

A subscription payment is made with additional value to cancel out previous subscription billing.

The Tax Rate Accounts automatically created by our system are simply fallback accounts. You can use whatever accounts you like to organize your revenue. Before allocating any sales or refunds to our fallback accounts, BETA checks for an account matching the Category of the Price associated with the line item.

For example, if I have prices allocated to the category “Cafe” in BETA, and a Quickbooks account called “Cafe”, any sales or refunds of those Cafe prices will be allocated to your Quickbooks Cafe account.

To further break down sales within a single account, you can append a colon and then a subclassifier to the Category name. For example, if I want to see the total sales per day of all beverages as a separate line in Quickbooks from the total sales of all food items, I might set up the two following Categories in BETA:

Cafe:Beverages

Cafe:Food

All revenue from both categories will be entered into the Quickbooks account called “Cafe”, but the Beverage and Food totals will have separate lines in the Journal Entry.

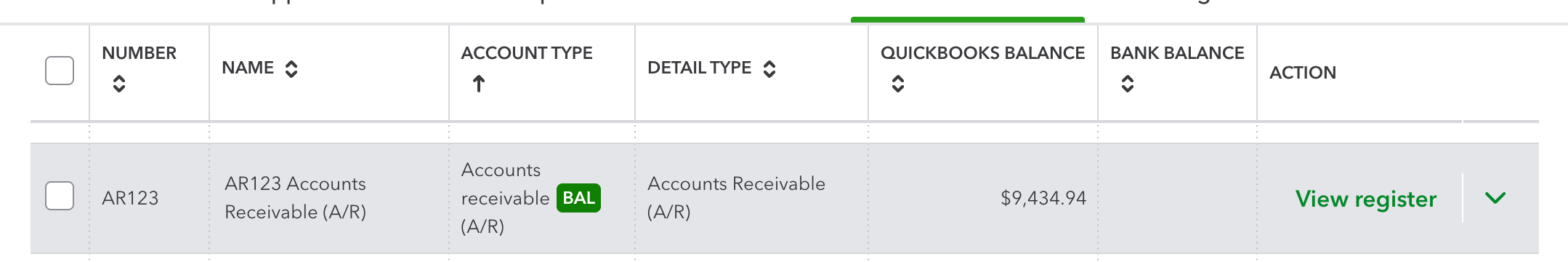

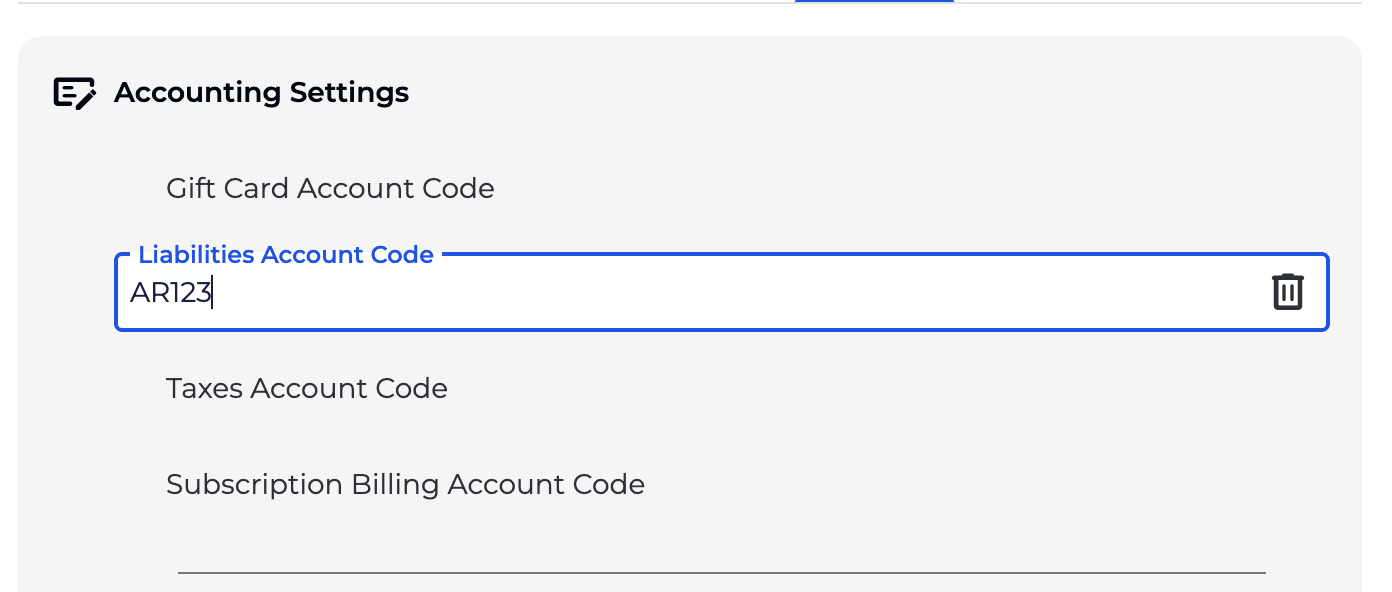

You can customize the Quickbooks accounts BETA uploads information to in your settings page. Simply enter the Quickbooks Account Number (in the example below, AR123) in the desired field and click Submit.

Some account types require a Customer Code or Vendor Code (Accounts Receivable and Accounts Payable, respectively) to be attached to a journal entry. If you’d like to use one of these accounts, please create a Customer or Vendor and enter the code in the relevant field in your BETA Accounting settings.

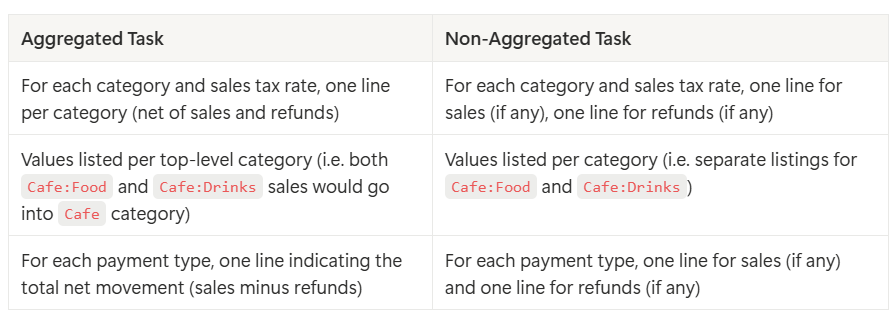

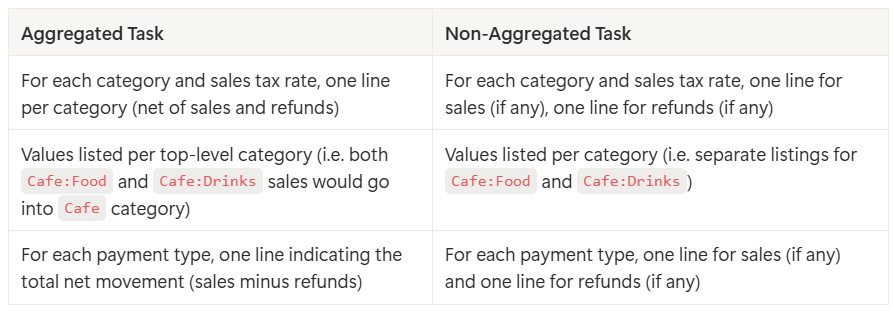

BETA offers two export formats for accounting: Aggregated and Non-Aggregated.

Aggregated gives a simplified summary, while

Non-Aggregated provides a more detailed breakdown of sales, refunds, and categories.

Choose the format that best fits your bookkeeping needs, and after setting up the integration, let the BETA team know which you would prefer

The BETA team will configure an automated task that runs daily at 1 am. This task serves the following purposes:

Creates a journal entry QB based on the integration you've set up.

Records total sales made, categorised by tax rate (credited to relevant sales accounts).

Logs total sales refunded, categorised by tax rate (debited from relevant sales accounts).

Documents total payments received, categorised by payment method (debited to the current account).

Tracks total payments refunded, categorised by payment method (credited to the current account).

Manages total deposits received for transactions not yet finalised (credited to current liabilities).

Handles total deposits exchanged for transactions closed today (debited from current liabilities).

Records total deposits refunded (debited from current liabilities).

Accounts for total gift cards redeemed (debited from current liabilities).

Logs total gift cards purchased (credited to current liabilities).

If you plan to add prices in the future with new tax rates, you may encounter an error in your integration. In order to avoid any errors, please contact us if you update your tax rates to ensure all necessary accounts are created in Quickbooks.

Gift Cards without Payment If you issue a gift card without receiving any payment in return, please be aware that you'll need to manually credit the liability in Quickbooks.

To access the Quickbooks integration feature in BETA, you must be on the Community and Above Tier, follow these steps:

From the BETA Dashboard, click the Settings option.

Click Integrations from the menu.

Select Quickbooks from the drop-down menu to initiate the integration.

Still Lost? We’ve got you covered!

Use the search box on the main Help to search the entire list of available help guides, or drop your question in the Support Chat!